| SD-WAN enhances security, agility, and cost-efficiency for the financial services sector, supporting regulatory compliance, reducing downtime, and improving customer experience. |

The financial services sector faces many challenges, such as stringent regulatory requirements, the need for enhanced security, and the demand for seamless connectivity to support constant connectivity between systems. In order to achieve this, many businesses within financial services have adopted Software-Defined Wide Area Networks (SD-WAN) solutions due to its key offerings better addressing these challenges than traditional WAN networks.

In this article we’ll explore how SD-WAN offers improved security, performance and agility for your financial services network, whilst also looking at how SD-WAN maintains regulatory compliance.

Table of Contents

Regulatory Compliance and SD-WAN

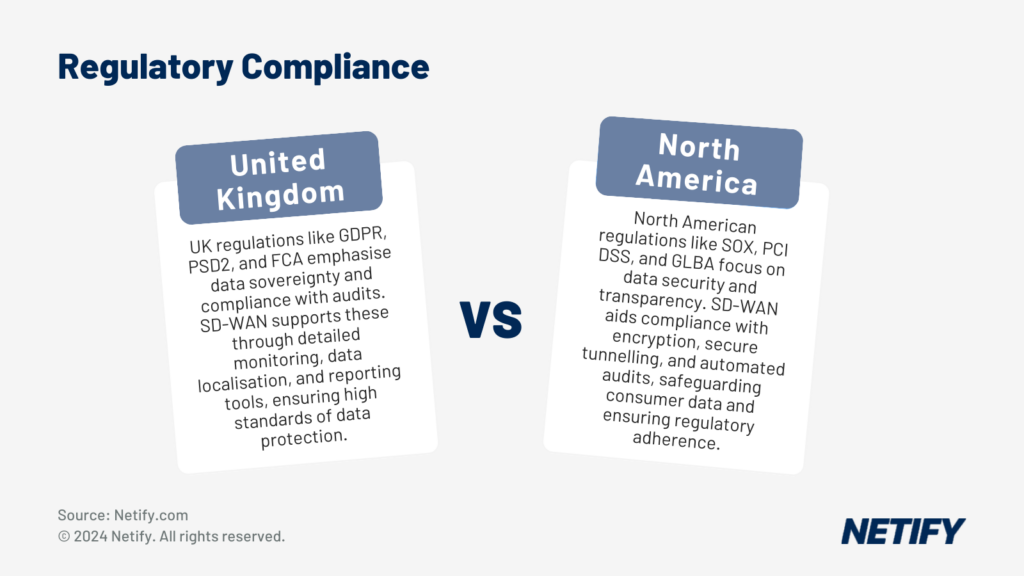

Differences in regulatory compliance for Financial Services within the UK and North America - Differences in regulatory compliance for Financial Services within the UK and North America

UK

Financial services operating within the UK must navigate regulations such as General Data Protection Regulation (GDPR), Payment Services Directive 2 (PSD2) and Financial Conduct Authority (FCA). These regulations often come with a need to restrict data to specific geographic boundaries and show compliance thorough regulatory audits, which can be aided by SD-WAN which offers features such as data sovereignty and compliance reporting tools that streamline audit processes. By providing detailed monitoring and logging, SD-WAN helps financial services to meet the high standards of data protection and accountability mandated by these regulations.

North America

In North America, the regulations are slightly different, which include the Sarbanes-Oxley Act (SOX), Payment Card Industry Data Security Standard (PCI DSS) and Gramm-Leach-Bliley Act (GLBA). To meet these regulations criteria, financial services must safeguard and protect consumer data, cardholder data and ensure transparency to prevent fraud. To achieve these, SD-WAN offers financial services features such as encryption, secure tunnelling, segmentation and advanced threat detection systems, which protects networked data, restricting access to sensitive information and ensuring that breaches do not compromise consumer data. SD-WAN also provides automated audit capabilities, maintaining detailed records of data access and networked activities, which can be crucial for showing regulatory compliance.

Enhancing Security with SD-WAN

Enhancing SD-WAN Security - Enhancing SD-WAN Security

The financial sector is a prime target for cyber-attacks, making data security a top priority for these businesses. To protect against attacks, SD-WAN offers encryption to protect data transmissions and secure tunnels to protect financial and personal data in transit between sites. These security measures ensure that data retains its confidentiality and integrity, both at the point of processing and storage, as well as whilst traversing the network.

SD-WAN integrations can also be coupled with Secure Service Edge (SSE) to make Secure Access Service Edge (SASE) solutions, providing the network with advanced threat protection tailored to the financial industry’s needs. SASE combines network security functions with SD-WAN to protect users, applications, and data. SSE focuses on securing user access to applications, enhancing the overall security of financial institution networks.

Whilst SD-WAN (and integrated SASE) solutions offer advanced security to protect against breaches, in the event of a breach, SD-WAN enables quicker response times to security incidents, minimising the impact on financial operations. With real-time visibility of network activities and automated threat detection, SD-WAN allows businesses to isolate and mitigate against threats, ensuring customer and sensitive data remains protected, which is essential for regulatory compliance and to avoid potential fines.

Another way SD-WAN achieves compliance with financial regulations is through its automation capabilities. Real-time monitoring and reporting tools provide an overview of network activity, ensuring any deviations from compliance standards can be identified and addressed, reducing the administrative burden on network administration teams.

Optimising Network Performance and Agility

Whilst security is key for protecting day-to-day operations within the financial sector, these daily business activities require network traffic to be managed for high-frequency trading, online banking and other critical financial services. To achieve this, SD-WAN offers Artificial Intelligence (AI) driven management, by analysing network patterns and anticipating traffic spikes, AI can ensure optimal performance and a reduction in latency, enhancing the user experience for both customers and employees.

Alongside automation of management, scalability is also a key factor for improving network performance and agility, due to financial services often experiencing rapid growth and fluctuating transaction volumes. SD-WAN provides scalable network solutions that can handle potential spikes in network activity without compromising performance, with dynamic bandwidth allocation ensuring that critical applications receive the necessary resources for efficient operation.

Finally, to improve agility, businesses using SD-WAN are typically moving to cloud infrastructure. As financial institutions increasingly adopt cloud services for banking platforms and mobile financial applications, seamless integration with these services is crucial. SD-WAN simplifies this cloud connectivity, ensuring secure and reliable access to cloud-based resources.

Financial Sector-Specific Cost Efficiency and ROI

Implementing SD-WAN offers significant cost-saving opportunities for the financial sector by reducing the reliance on MPLS. Traditional MPLS networks have high operational costs due to expensive leased lines and inflexible bandwidth allocation and by moving to SD-WAN, financial businesses can leverage more cost-effective broadband internet connections while maintaining high performance and security.

One key advantage of using SD-WAN for the financial sector is the reduction in hardware and maintenance costs. SD-WAN solutions offer many built-in software features and therefore require less physical infrastructure to fulfil the same functionality, which reduces the need for costly hardware investments and ongoing maintenance. These software-based functions can be controlled and managed via SD-WAN’s centralised management capabilities, which streamline network operations and enable remote management, reducing the need for extensive on-site network administrative staff and minimising operational expenses.

Whilst reducing the reliance on MPLS and staffing requirements provides a significant day-to-day reduction in expenses, reports have shown that the ROI benefit of SD-WAN to the financial sector can also be realised through reduced downtime and increased transaction speeds, which improves continuous efficient operations.

Enhancing Customer Experience

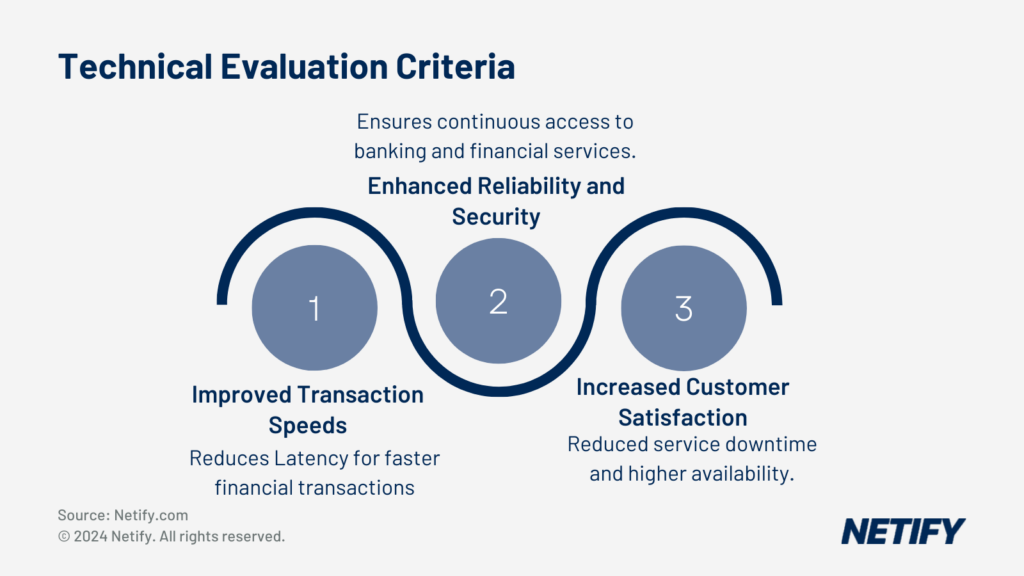

SD-WAN Technical Evaluation Criteria for Financial Services - SD-WAN Technical Evaluation Criteria for Financial Services

One way that SD-WAN increases the efficiency of operations is through SD-WAN improving transaction speeds, which leads to better user experiences when completing financial transactions. By optimising network performance and reducing latency, SD-WAN ensures that financial services are delivered quickly and efficiently.

Reliable and secure online banking and financial services are essential for building customer trust. SD-WAN enhances network reliability and security, ensuring that customers can access their accounts and conduct transactions without the risk of having their account compromised, with improved service availability and reduced downtime leading to higher customer satisfaction and loyalty.

Business Continuity and Disaster Recovery in Finance

Given the importance of ensuring uninterrupted transactions, the financial sector cannot allow for service disruptions. SD-WAN offers increased resiliency through dynamic path selection and redundancy. Redundant paths are utilised for seamless failover switching in the event a single network link experiences downtime, maintaining continuous service availability, even in the event of a disaster. This reliability ensures that financial services can operate smoothly, regardless of adverse conditions, protecting both the business and its customers

In the event of a disaster, during the recovery process, SD-WAN supports regulatory compliance by ensuring that financial services can quickly resume operations without violating data protection laws. Automated failover mechanisms and real-time monitoring enable the financial sector to maintain compliance whilst recovering from disruptions.

Future Trends in SD-WAN for Financial Services

SD-WAN vendors have increasingly begun to support 5G networks, which offers high speeds and low latency to supplement financial services networks. This enables financial services to offer faster and more reliable services to their customers, whilst also being able to use 5G as a failover system, as opposed to wired solutions such as broadband internet.

Conclusion

SD-WAN is essential for the financial services sector due to its security, performance and regulatory compliance functionality. Features like encryption, secure tunnelling and SASE integrations protect data and meet compliance standards. AI-driven management and dynamic bandwidth allocation ensure seamless operations and cloud connectivity, whilst SD-WAN reduces costs by minimising reliance on MPLS networks and lowering hardware expenses. The improved transaction speeds and reliable service enhance customer satisfaction and disaster recovery capabilities ensure business continuity. The future integration with 5G promises even faster and more reliable connectivity, making SD-WAN crucial for a secure and efficient financial industry.